How to Measure Brand Equity

Think about some of your favorite brands and how you feel towards them. Here at GutCheck, we love LaCroix. If you were to take it away from us, there might be some serious consequences.

Brand equity is the result of those evolving feelings and the need to predict the influence a brand name, or other aspects besides the physical product or service, may have on purchase intent. In other words, as a brand evolves and creates new products, it’s no longer just about the product or service itself; other factors—like that brand name—could have an impact on a new product’s performance.

Brand equity can be an abstract and difficult thing to measure; however, it’s not impossible to. As a result, we wanted to share the key aspects of brand equity and our approach to measuring its qualities. Specifically, by combining big data and survey data, we’re able to develop two metrics that contribute to our understanding of brand equity.

What Is Brand Equity?

As mentioned, brand equity is the value a brand receives due to consumer perceptions associated with the brand rather than the product or service. These consumer perceptions usually result as a consumer builds up a memory of a brand over time through various experiences with it. Essentially, brand equity establishes who a brand is, what they are, what they’re about, and what that means to the consumer.

The evaluation of brand equity is a little bit different. It is the measure of the degree to which a brand is healthy or strong enough to generate real value, like a purchase or increased usage. Further, when we talk about consumer perceptions when measuring brand equity, we’re talking about the attitudinal mindset and factors that determine whether consumers are aware of a brand, and how they feel—negatively or positively—about the brand. These perceptions can be assessed to understand the scale to which consumers believe in the value of a specific brand—also known as brand loyalty.

Measuring brand equity is the key to learning what efforts a brand should take in growing their market share. It can also capture other indicators of brand performance, such as how memorable, recognizable, or reliable consumers feel the brand is. These qualities impact brand perceptions and ultimately the propensity to buy the brand’s products or services.

Defining Brand Equity Through Loyalty

Brand loyalty is an aspect of brand equity, and in our case for measuring it, one of the most important aspects. There are two major factors of brand loyalty that translate to how we measure brand equity:

- Behavioral factors: measurements based on purchasing patterns like the frequency of repeat purchases.

- Attitudinal factors: measurements based on consumer mindsets and how a brand meets needs—it can measure consumers’ psychological desire for a brand.

When available, leveraging big data to understand market share, the number of brands purchased, and other metrics derived from actual purchase behavior can gather the insights needed to understand behavioral factors of brand loyalty. However, if big data is not accessible, as was the case in the past, then survey research using stated purchase behavior can be used.

On the other hand, since attitudinal factors are based on consumer mindsets, it doesn’t follow usage. As a result, we assess consumer perceptions and attitudes towards brands using a battery of survey questions and then compute an attitudinal equity score based on those questions. We then sum these scores to create another market share metric—one that measures the relative ‘goodwill’ each brand has built up in the consumers’ minds.

Measuring the Gap

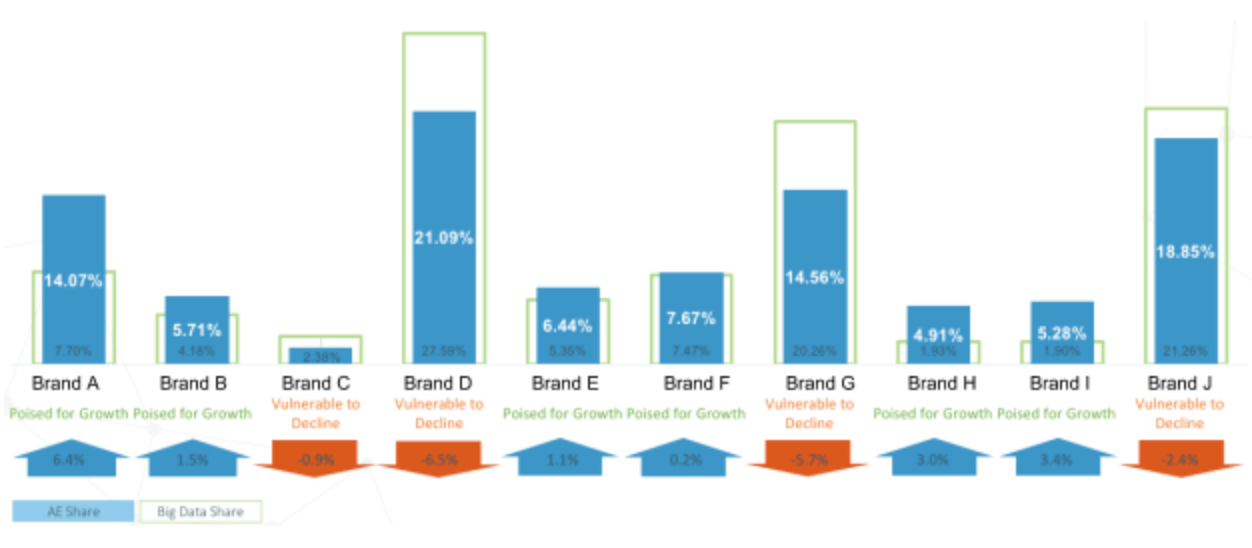

Our research approach combining big data and survey data uses both behavioral and attitudinal factors to measure loyalty. This technique results in a better understanding of potential brand growth opportunities and an easier path to measuring brand equity. By measuring the gap between attitudinal factors and market share, brands can get a clearer picture of how they compare to the rest of the market:

When attitudinal equity (AE) is lower than market share (big data share), a brand is vulnerable to decline. Such brands may have to offer discounts or run promotions to maintain share since they have captured fewer hearts and minds relative to their market share. When attitudinal equity is lower than market share, a brand is poised for growth since the brand has already won more hearts and minds than are currently buying the brand.

Our attitudinal equity and market share assessment above is based on similar measures used for years by market research companies such as Ipsos and Kantar TNS. We chose our measure of attitudinal equity for a variety of reasons—a few being speed, ease of comparability, and transparency. To learn more or see an example of our measurement of attitudinal equity in the coffee category space, download the infographic below.

Want to stay up to date latest GutCheck blog posts?

Follow us on

Check Out Our Most Recent Blog Posts

When Vocation and Avocation Collide

At GutCheck, we have four brand pillars upon which we build our business. One of those is to 'lead...

Reflections on Season 1 of Gutsiest Brands

Understanding people is at the heart of market research. Sure, companies want to know what ideas...

Permission to Evolve with Miguel Garcia Castillo

(highlights from Episode #22 of the Gutsiest Brands podcast) Check out the latest lessons from our...

1-877-990-8111

[email protected]

© 2023 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.

© 2020 GutCheck is a registered trademark of Brainyak, Inc. All rights reserved.